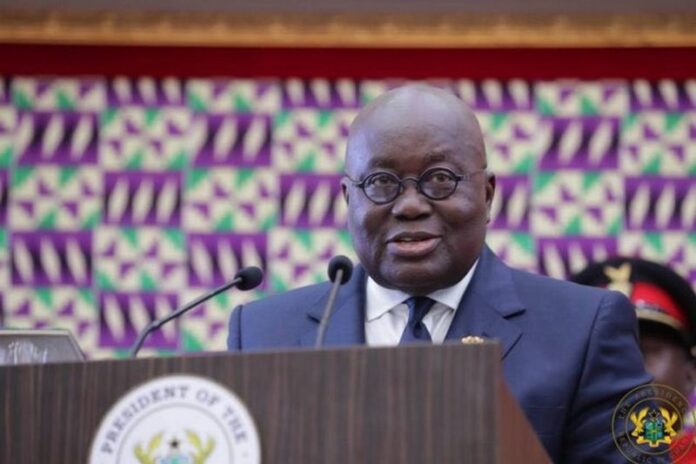

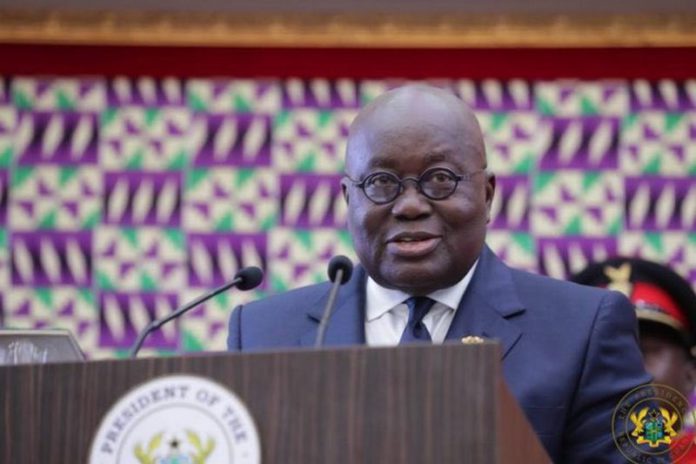

President Nana Akufo-Addo has taken on global rating agencies describing their work as reckless and unfriendly, especially towards struggling developing economies.

At the height of Ghana’s economic crisis, all the rating agencies downgraded the country’s creditworthiness to junk status.

The rating resulted in Ghana being blocked from assessing the capital market.

Addressing participants at the ongoing 30th Afrieximbank annual general meeting in Ghana, President Akufo-Addo said: “The AU champion for African financial institution and leader of a country which recently had to deal with one of the most difficult periods in its post-independent history.

“Difficulties which were exacerbated by the reckless behaviour of rating agencies that engaged in downgrade shutting Ghana out of the capital market and turning the liquidity crises into solvency crises.”

According to him, during the country’s economic crises, Afrieximbank provided the needed support to help “Ghana navigate the macroeconomic management challenges worsened by Russian aggression war in Ukraine in an orderly manner when suddenly we realise we were alone.”

As a result, the President believes Africa must develop its own financial institutions for support during a crisis.

Meanwhile, the effects of the economic crisis are hitting all sectors of the economy and the Finance Minister, Ken Ofori Atta, has indicated that the energy sector will undergo some vigorous reforms to save the sector from collapsing.

This comes after the sector’s legacy debt reached about $2 billion as of the end of May 2023, and an estimated shortfall of $5.9 billion between 2023 and 2025, due to the current conditions of State Owned Enterprises and Independent Power Producers in the value chain.

According to him, these reforms will sustainably reduce losses in the energy sector and pay off the debt which threatens the sector.

He furthered that an implementation of an inter-utility debt settlement framework on a quarterly basis will start in June 2023.